Financial resolutions are one of the top 3 new year resolutions (NYR) people make. What financial resolution should you make?

It depends – – on what your money personality style is. Olivia Mellan describes 5 basic money personalities in her book Money Harmony. Most people are predominantly one style with some traits of a secondary style. Which style are you? Take this quiz to find out > Financial Personality Quiz . There isn’t one style that is better than another. Each has good qualities and short comings. The key is to keep your style in balance.

Hoarders love managing their money. They will have financial goals and prioritize these goals. They can complain about the cost of items – especially those seen as frivolous. Their gifts are ALWAYS practical – like the husband who gave his wife a vacuum for an anniversary present. (They are no longer married.)

So, what would a new year resolution be for a Hoarder? Their house is usually in good financial order. A resolution would be along the line of ENJOYing their money and the benefits it can provide.

NYR:

- Buy a frivolous gift for a loved one or for yourself.

- Take a friend to lunch.

- Practice giving to others weekly and giving frivolous, decadent gifts.

Spenders tend to be impulsive buyers. They are looking for immediate pleasure in their purchases. They tend to be emotional spenders – when the going gets tough the tough go shopping. They don’t like budgets. It is hard for them to hang on to any savings.

NYR:

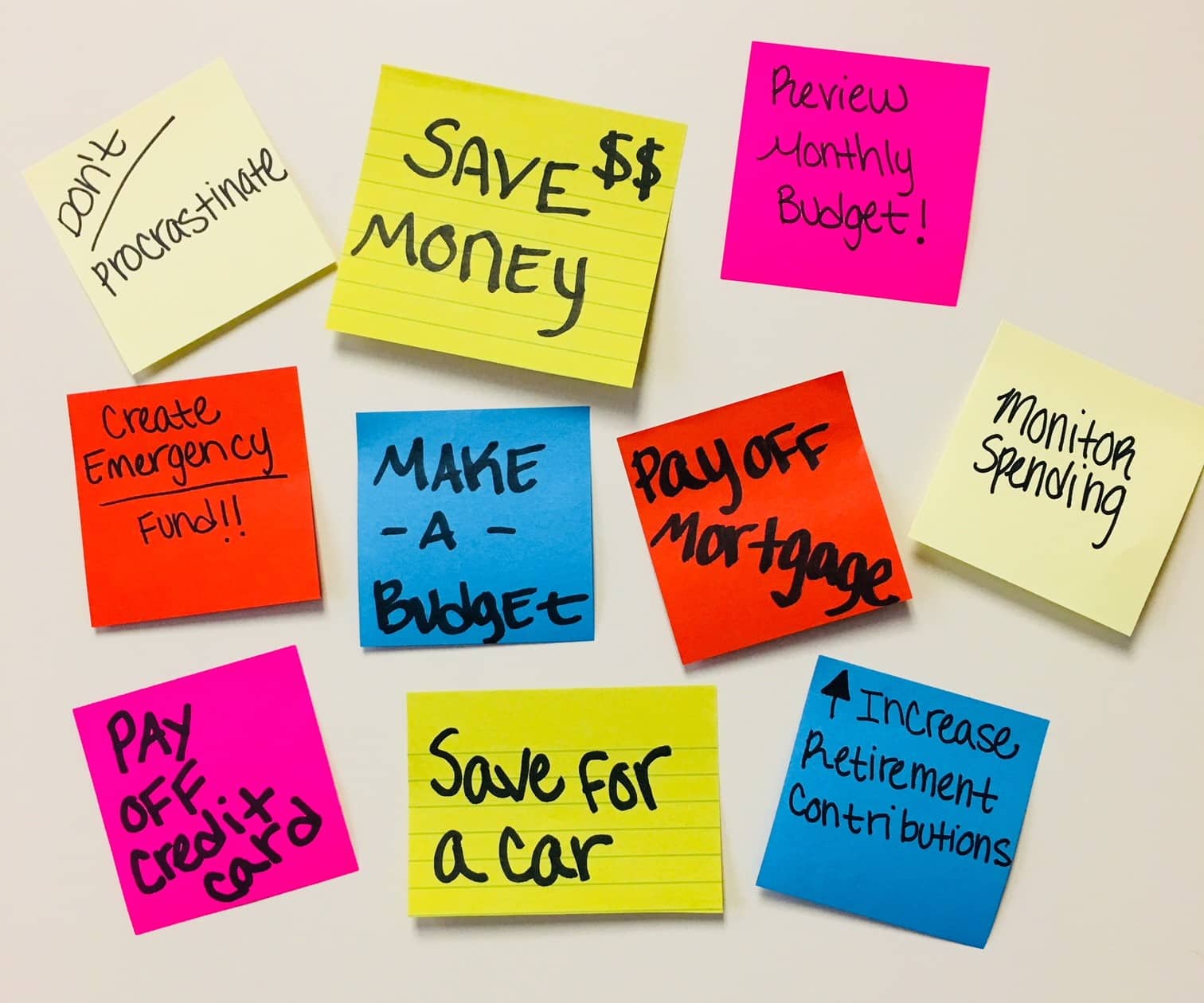

- Write down what you spend for 1-week listing amounts and items. Evaluate your behavior. Choose 1 thing to change like fewer lattes.

- Make a Spending Plan & monitor monthly (Perception change on purpose of budget.)

- Set up automatic saving contributions especially retirement.

Avoiders do just that – avoid all thing financial. They don’t open their mail regularly. Bills are frequently late. They don’t do bank reconciliations. They are the last to do their tax return, filing extensions.

Avoiders don’t know what they have, what they owe or what they spend.

NYR:

- Set up auto deposit for paychecks

- Set up auto pay of bills

- Do monthly review of your financial picture. You might invite a financially savvy friend to join you.

- Set a savings goal – for an emergency fund and retirement.

Ammassers are happiest when they have large amounts of money to spend, save or invest. They feel empty without having money to manage. They often equate their amount of money to self-worth & power. The flip is also true. If there is lack, they feel like a failure.

NYR:

- Take a regular break from monitoring your money. Begin with 1 day and add additional days over time. Strive for only weekly monitoring.

- Find a desire, dream or goal that doesn’t take money and isn’t about money. Experiment with finding pleasure from something else like a hobby or volunteering.

Money Monks are uncomfortable with money. They tend to have a modest lifestyle. They feel money is evil or dirty. Too much money will corrupt you. They are the last to collect their inheritance.

NYR:

- Study wealthy people you like & respect. How do they handle their money?

- Imagine having great wealth. What good things could you do with great wealth?

Remember, every style has good qualities and short comings. Your resolution is to keep your money personality in balance.