What is the right time to start taking money from your retirement accounts?

What is the right time to start taking money from your retirement accounts?

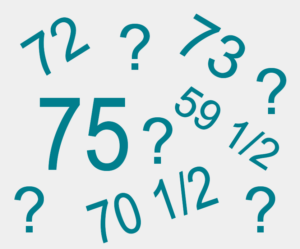

Congress decided in the SECURE Act 1.0 the age was 72. However, Secure Act 2.0 pushed the mandatory starting date to 73. In 2033, the date can be further delayed until age 75.

Should you delay taking money from your accounts?

When planning cash flow in retirement, you consider your first day of retirement AND your last day of retirement.

- What is the need today? What will it be in 20 to 30 years?

- What is the tax rate today? What will it be in 20 to 30 years? Probably not lower.

- How much do you have in retirement accounts? How much will Required Minimum Distributions (RMD) add to your tax picture? What is your Income-Related Monthly Adjustment Amount (IRMAA) calculation?

- Are you leaving a tax bomb for your children?

Let’s look at a couple of common scenarios.

Scenario 1

George and Sally, both age 70, need cash flow of $4,000 a month. Social security provides $3,000 monthly. Sally has a pension of $1,000. Today their monthly benefits meet their daily needs.

At age 73, they begin withdrawing their Required Minimum Distribution (RMD). This amount is determined by the value of the Retirement Account at the end of the prior year divided by the life expectancy of the participant in the current year.

George’s $200,000 IRA requires $7,550 RMD

Sally’s $100,000 IRA requires a $3,775 RMD

That increase in income will likely leave them in the same tax bracket as prior years.

That modest draw on their retirement accounts, will help deflect rising costs. And leave monies for later in life when medical costs will likely be higher.

George and Sally have 3 children. If they both died today, the kids would split $300,000. Under the new Inherited IRA rules, they each would have to distribute $100,000 over a 10 year period. That is approximately $10,000 a year – not a huge tax burden.

The Congressional delay in drawing RMDS is beneficial for them.

Scenario 2

George and Sally have the same monthly income and expenses. No need to draw from their retirement accounts at this time.

George’s $300,000 IRA generates $11,320 of RMD.

Sally’s $500,000 IRA generates $18,870.

That increase of $30,190 in income will cause more of their social security to be taxable. The RMDs definitely move them to a new tax bracket.

If George and Sally both died today, their 3 children would split $800,000 in retirement benefits. Or $267,000 each. Resulting in additional income of $26,700 over 10 years. This would require some tax planning.

George and Sally may have benefited by drawing down their retirement accounts before the RMD age. That would reduce the amount of RMDs required. Or they could convert some or all of their IRA to Roths. (This is best done before starting Medicare and social security for less tax impact.)

Inheriting a Roth has no tax consequences. A beneficiary still has to empty their account by the end of the 10th year.

Scenario 3

Now we have a couple Don and Jan. They had good jobs, accumulated retirement assets, investments and rental properties. From all their sources of income, they are easily covering their monthly income of $10,000. Delaying the start of RMDs may seem beneficial as it will keep income taxes down.

However, RMD on a $2,000,000 IRA is over $75,000. That not only changes their tax bracket but subjects them to additional Medicare premiums. (Income-Related Monthly Adjustment Amount – IRMAA – sets the rules for the cost of your Medicare based on your Adjusted Gross Income.)

Children inherit the retirement accounts and the tax consequences.

Don and Jan may have benefited from using their retirement accounts to live from as soon as they retired. Doing Roth conversions years earlier would reduce their tax picture today and eliminate or reduce their RMDs.

Required Minimum Distributions are a ‘suggestion’ of when to start taking money from your retirement accounts. Evaluating your taxes today and Medicare premium may suggest a different strategy.

Call our office for a complimentary discussion on planning your cash flow from Day One of retirement through your last day.

The above scenarios are for illustrative purposes only and are hypothetical in nature. Always consult with your investment professional prior to making any major decisions.

What is the right time to start taking money from your retirement accounts?

What is the right time to start taking money from your retirement accounts?